How Valuable is Australia’s Refundable R&D Tax Offset on a Global Scale?

February 29th, 2016Ultimately, investing in research and development (R&D) is key to increasing innovation, productivity and competitive advantage. It is not only beneficial for businesses, but is also advantageous for the economy of our country. In fact, for many multinational companies, Australia has become the centre of their global R&D activities. This is primarily due to a highly skilled workforce, suitable infrastructure and a favourable R&D tax incentive program.

Australia’s R&D Tax Incentive, which has replaced the R&D Tax Concession since the 1st of July 2011, offers research and development tax offsets designed to encourage more companies to engage in R&D. The incentive was implemented to boost innovation at a time when companies were struggling to access capital. In particular cases, it offers a 43.5 percent refundable tax offset for R&D expenses in the form of annual cash rebates to companies that have less than $20 million in revenue and file tax returns in the country. Thus, for a research-intensive company, the tax benefit is a welcomed non-dilutive source of funding for R&D activities.

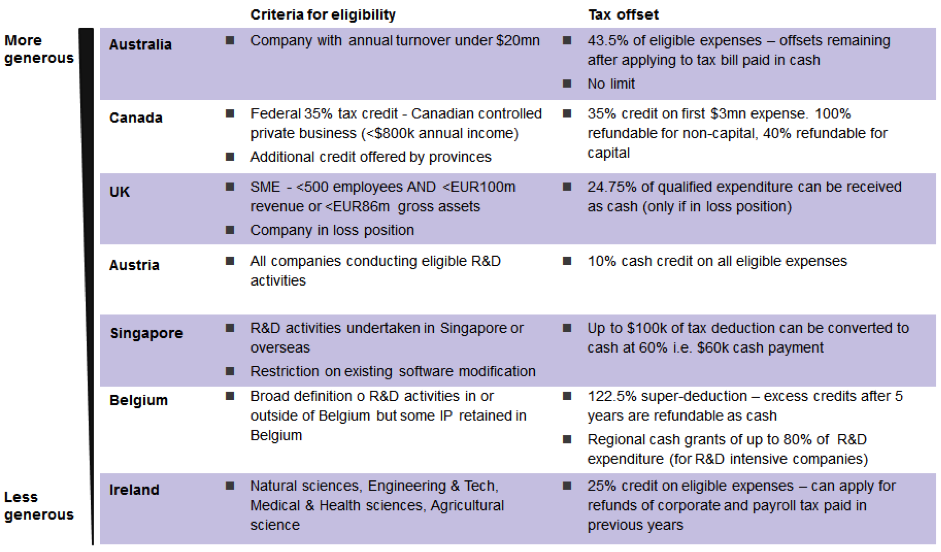

Previously, we’ve compared government support for business R&D in Australia, China, Canada, United Kingdom, United States and India. The infographic of this comparison can be found here. Alternatively, you can download the pdf here: R&D Incentives Around The Globe . In addition, Australia’s cash back schemes tops OECD comparison. However only a handful of countries (viewed in the table below) offer refundable tax offsets and Australia’s refundable tax offset is the most favourable in parallel to other countries.

In accordance with the table above, Australia’s R&D Incentive program is indeed quite auspicious when compared on a global scale. Ultimately, the driving force behind the R&D Tax Incentive is to inspire more companies to engage in R&D in Australia. And it’s working: a number of companies have overtly stated that they have set up in Australia because of the support provided by the R&D Tax Incentive. The international benchmarking of Global R&D Tax Schemes within this post highlights that the Australian R&D tax incentive system is relatively competitive with international regimes.

However, as we’ve mentioned earlier, the type of offset differs depending on the turnover of the company and the amount of R&D expenditure incurred. Nonetheless, the R&D tax incentive remains one of the most reputable sources of funding and support for businesses in the research, development and early developmental commercialisation phases. Overall, Australia’s R&D tax incentive programme has become well regarded internationally and, combined with the recent decline in the Australian dollar, has been a driver of overseas investment in Australian R&D.

Please contact one of Swanson Reed’s Specialist R&D Tax Advisors if you are interested in learning more about the R&D incentive and what this can mean for your business.

Categories

- ATO Guidance and Materials

- AusIndustry Guidance and Materials

- Case Law

- Federal Budget 2021

- Federal Budget 2022

- For Accountants

- General Information

- Government Policy and Treasury

- Industry Specific Issues

- Interpretative Decisions

- Legislation and Parliamentary Matters

- R&D Tax Credit

- R&D Tax Funding Strategies

- R&D Tax Loans

- Recent News

- Tax Determinations

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- September 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- May 2013

- April 2013

- March 2013

- September 2012

- August 2012

- June 2012

Free Call: 1300 009 390

Free Call: 1300 009 390

News & Research

News & Research