Innovation at the Farm Gate: How Australia Can Leverage a Growing Agriculture Sector

February 19th, 2016Between now and 2050 the world’s food system will need to harvest 70 per cent more food to nourish an increasingly crowded world. As the global population trudges towards 9 billion by 2050 and land and water resources decline, never has the task of producing more from less been more imperative. Essentially, these figures reveal that the role of Agriculture on a global scale will no doubt become more paramount in the following years.

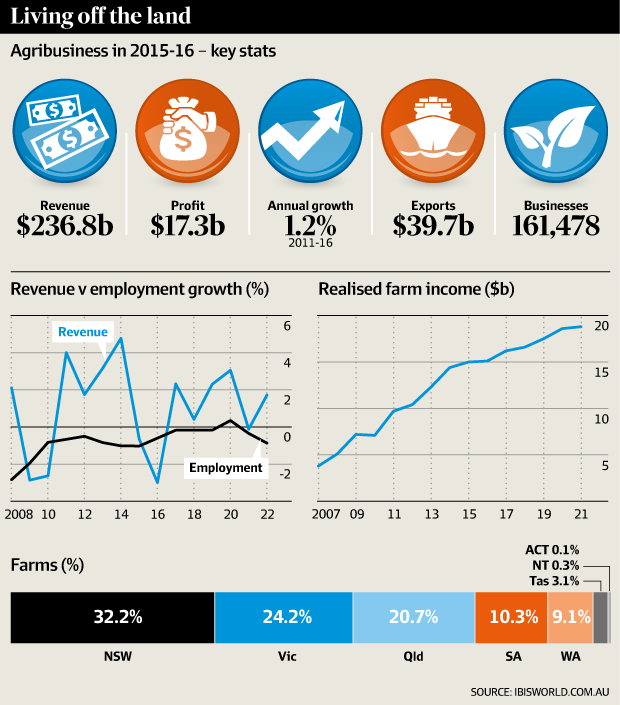

In fact, Agriculture is one of the fastest developing fields of the Australian economy, with copious untapped potential. The agricultural sector has actually observed five successive years of resilient growth, and with record output of $57.6 billion in raw produce forecasted for this financial year –which is up 8 per cent last year’s levels. Even if growth stagnates, the National Farmers’ Federation (NFF) reveals agriculture is on the way to be our country’s next $100 billion industry by 2030 – the size of iron ore and coal combined. As the graph below reveals, the terrain for growth in the field of agriculture is mounting.

Ultimately, the key to unlocking this productivity growth for Australian agriculture is innovation. Whether this is through new technologies, smarter farm management and improved business models, innovation will be fundamental in meeting increased demands.

Furthermore, increasing competition from overseas markets means that Australia cannot rely on just being a quality producer anymore, thus technology should be utilised to drive labour efficiency and more. From drones and sensors to GPS tracking devices, Australia’s march to a more innovative, digital economy could certainly assist in unlocking the next wave of productivity needed to keep Australian agriculture competitive.

However, how does the agriculture field go about leveraging this innovation and technology? Research and development (R&D) is one of the key drivers of innovation as it leads to the creation or improvement of products, processes or systems. Hence, innovation in terms of R&D could largely benefit the agriculture sector – particularly in regards to global competitiveness, lowering processing costs and future environment considerations.

Despite not traditionally being observed as a digital industry, the agriculture sector could still advantage from Turnbull’s mission to transform Australia into a more innovative and collaborative society. In specific, the government currently provides generous tax savings for eligible R&D activities under the R&D Tax Incentive. Swanson Reed provides specialist expertise transversely to a broad range of industries and has assisted many clients attain tax cash savings under the R&D regime. Contact one of our specialist R&D Tax consultants to find out more about the scheme.

Categories

- ATO Guidance and Materials

- AusIndustry Guidance and Materials

- Case Law

- Federal Budget 2021

- Federal Budget 2022

- For Accountants

- General Information

- Government Policy and Treasury

- Industry Specific Issues

- Interpretative Decisions

- Legislation and Parliamentary Matters

- R&D Tax Credit

- R&D Tax Funding Strategies

- R&D Tax Loans

- Recent News

- Tax Determinations

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- September 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- May 2013

- April 2013

- March 2013

- September 2012

- August 2012

- June 2012

Free Call: 1300 009 390

Free Call: 1300 009 390

News & Research

News & Research