Australia’s R&D Tax Cash Benefit Tops OECD Comparison

April 20th, 2016Undeniably, policies aimed at growing national research and development (R&D) activity is now a central element of national tactics to increase productivity, long run economic growth and international competitiveness in most countries.

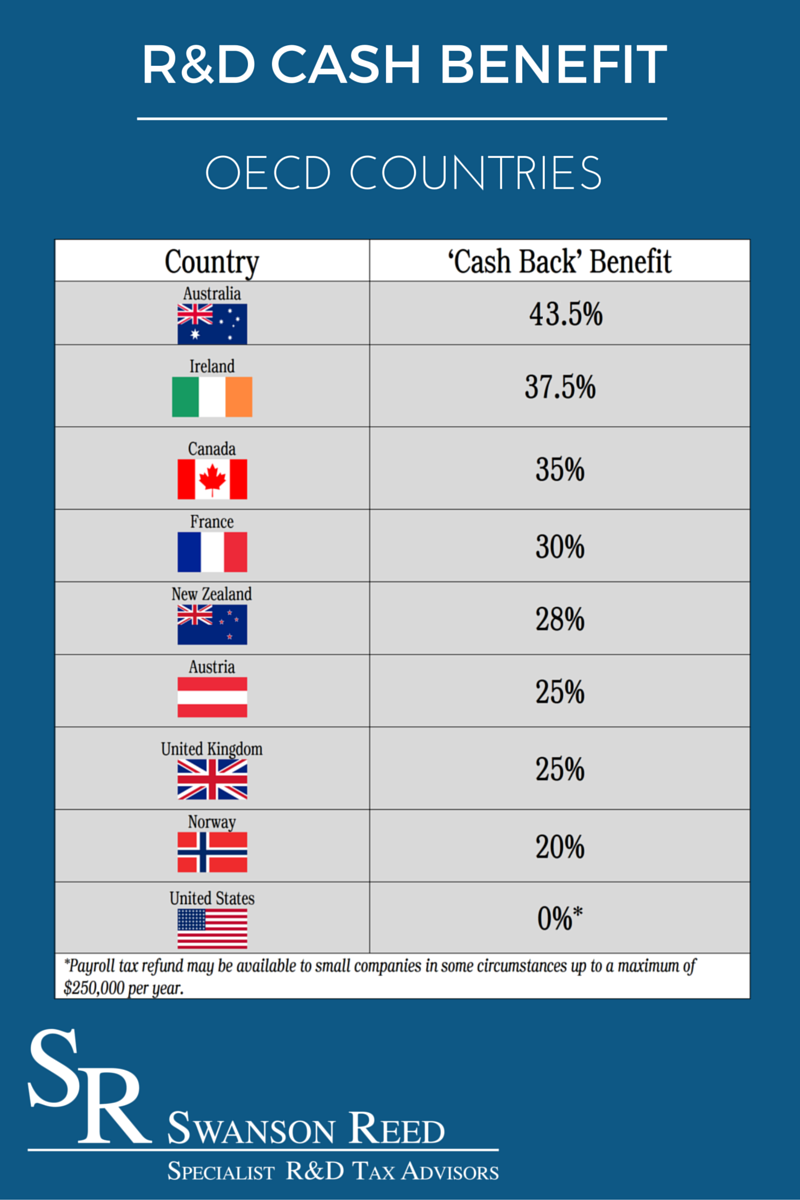

According to the OECD, the largest amount of R&D tax support, in relative terms, was provided by the Netherlands with 87% as percentage of total government support; however, Australia is a close second with 85% as percentage of total government support. Moreover, Australia actually tops the globe for loss making entities with the 43.5 per cent cash back benefit under the R&D Tax Incentive scheme.

To elaborate, the infographic below reveals a comparison of R&D cash benefits in OECD Countries.

Overall, the number of companies accessing R&D tax benefits from the Australian government has augmented to beyond 13,000 over the years. Over 7,000 small businesses currently apply for the program, however over 20,000 small businesses are actually eligible to claim. Despite the fact that the Research & Development (R&D) tax incentive claim process can seem quite convoluted, the benefits of doing it properly are well worth the effort. Swanson Reed specialises in the R&D Tax Credit – contact us today to discuss your eligibility and learn more about how the R&D Tax Incentive may benefit your business.

Categories

- ATO Guidance and Materials

- AusIndustry Guidance and Materials

- Case Law

- Federal Budget 2021

- Federal Budget 2022

- For Accountants

- General Information

- Government Policy and Treasury

- Industry Specific Issues

- Interpretative Decisions

- Legislation and Parliamentary Matters

- R&D Tax Credit

- R&D Tax Funding Strategies

- R&D Tax Loans

- Recent News

- Tax Determinations

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- September 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- May 2013

- April 2013

- March 2013

- September 2012

- August 2012

- June 2012

Free Call: 1300 009 390

Free Call: 1300 009 390

News & Research

News & Research